Benefit Summary

The Dependent Tuition Waiver covers up to 60 Collin College credit hours for qualified

full-time employee dependents under age 24. Procedures are outlined in Board Policy

DEB(Local), DK(Legal), and Texas Education Code 54.211.

and Texas Education Code 54.211.

Employee Responsibilties

Employee responsibilities are outlined in the employee requirements on the Dependent Tuition Waiver.

Dependent Eligibility

Employee dependents must be under 24 years of age and identified as a dependent in one of four ways:

- Dependent is included on employee’s state-sponsored health insurance.

- Dependent is included on a Free Application for Federal Student Aid (FAFSA).

- Dependent status is indicated on Internal Revenue Service (IRS) tax documents.

- Dependent status is indicated on other legal, government-issued or court-issued documents.

Dependent Eligibility Verification

HR will randomly select Employee Dependent Tuition Benefit Authorization Forms to audit on an ongoing basis. If selected during an audit, the employee must furnish documentation indicating dependent eligibility. This must be submitted in person to the Training and Development Team within 15 calendar days of the initial email request for verification. Failure to provide required information by the deadline may result in removal from the program and repayment of tuition.

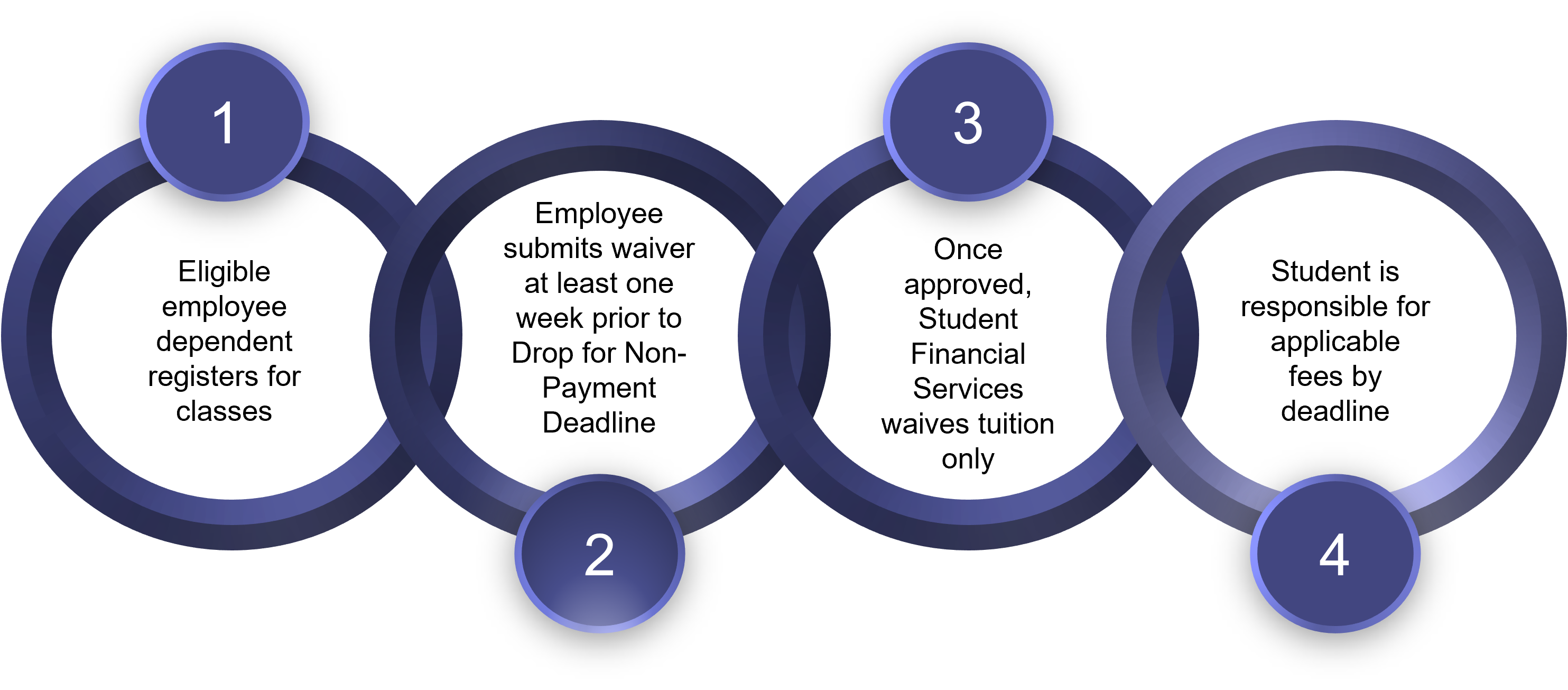

Program Process, Deadlines, and Form

Program Contact

Please email TrainingAndDevelopment@Collin.edu with questions.